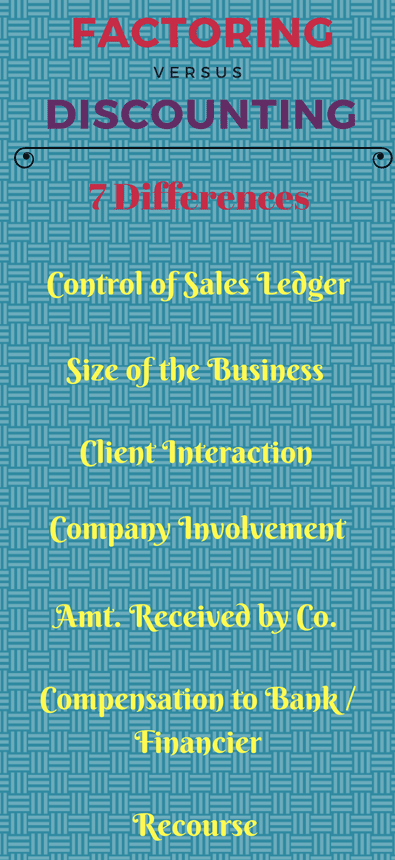

If your company can meet the credit qualifications, then a bank line of credit may be the better choice for you.īoth a bank line of credit and invoice factoring can be beneficial for small businesses. Generally, a bank line of credit has some of the lowest interest rates in the marketplace, which can make it the most affordable option. On the other hand, invoice factoring can carry higher fees than a bank line of credit. In this situation, a company with little access to credit may benefit by choosing invoice factoring. On the other hand, invoice factoring is very easy to qualify for, since it is based on the creditworthiness of customers rather than the business owner. For example, getting a bank line of credit can be very difficult for entrepreneurs, especially those who have only been in business for a short time. If you're unsure which funding option to use for your company, think about the advantages and disadvantages of each. In most cases, the factoring fee is only a few percentage points of the lump sum. Once customers pay off the invoices in full, the third party sends the remainder of the cash sum to the business after deducting its fee. The third party company sends most of a cash sum in exchange for assuming the right to collect on the invoices. Rather than borrowing a cash sum on credit, this arrangement works by allowing businesses to sell their accounts receivable value to a third party. Invoice factoring, though, is quite different. Generally, the bank only charges interest when the funds are actually borrowed. One of the biggest advantages of a bank line of credit is that the lending arrangement is already approved, which makes it easy for the company owner to get the cash funding in a hurry. The bank extends a certain amount of credit to the company that is available whenever the company needs it. When a company has access to a bank line of credit, the owner is able to get additional capital at any time. While both of these financing options may be available, they each carry their own benefits and disadvantages. Two of the most common types of funding are bank lines of credit and invoice factoring.

The problem for small business owners is that it can be difficult to decide which type of financing to use. Get your working line of credit now with our invoice factoring program. In these times, most entrepreneurs begin considering outside financing such as loans, grants, and venture capital. Invoice Factoring Line of Credit Invoice Factoring is a simple, fast and affordable way to turn your open invoices into immediate cash. Small businesses often face cash flow problems, especially during times when revenue slows down or costs suddenly increase.

0 kommentar(er)

0 kommentar(er)